Are You Shipping Me? (Container 1 of 6)

Since 2020, global shipping has been frenetic, with equally frenetic shipping rates (figure 2); difficulties for both

1. businesses and

2. consumers; and

3. container-carrier profits.

[In Figure 2, above, a TEU

is a 'Twenty-foot Equivalent Unit', a standard cargo measure.

So during the COVID-19 pandemic the $/TEU went from below

2,000 to about 11,000!]

Is Covid-19 driving these developments, or are there other structural and cyclical factors at play? Let’s take stock.

One root of the problem…

In 2020, COVID-19 become a global pandemic, and lockdowns ensued:

- factories,

- restaurants, and

- shops

all closed, bringing global supply chain almost to a halt.

In this context, container carriers had no visibility on future demand and did the only reasonable thing: cut capacity.

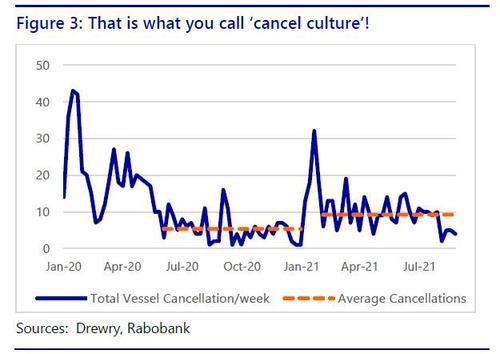

There is no economic sense in moving half-empty ships across the globe; it is costly, especially for a sector operated on tiny margins for a very long time. The consequence was widespread vessel cancellations, which soared in the first months of 2020 (figure 3). Progressively, more trade lines and ports were involved as containment measures were enacted globally.

By H2-2020, virus containment measures were over in China, and many other nations eased them too. Shipping cancellations did not stop, however, just continuing at a slower pace. Indeed, capacity cuts have plagued supply-chains in 2021.

Excluding the January-February peaks, from March to September 2021, an average of 9.2 vessels per week were cancelled, four vessels per week more than the previous off-peak period of July to December 2020 (figure 3).

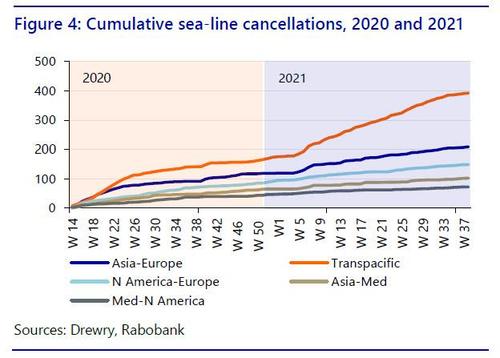

Cumulative cancellations (figure 4) underline the problems. Transpacific (e.g., China-US) and Asia-Northern Europe lines saw the largest capacity cuts, but Transatlantic and Mediterranean-North America vessels also reached historic levels of cancellations.

Transpacific and Asia-Europe lines are the backbone of global trade, each representing 40% of the total container trade. More than 3 million TEUs (Twenty-foot Equivalent Units, a standard cargo measure) are moved on Transpacific and Asia-Europe lines in total per month. Due to cancellations, more than 10% of that capacity was lost in early 2020.

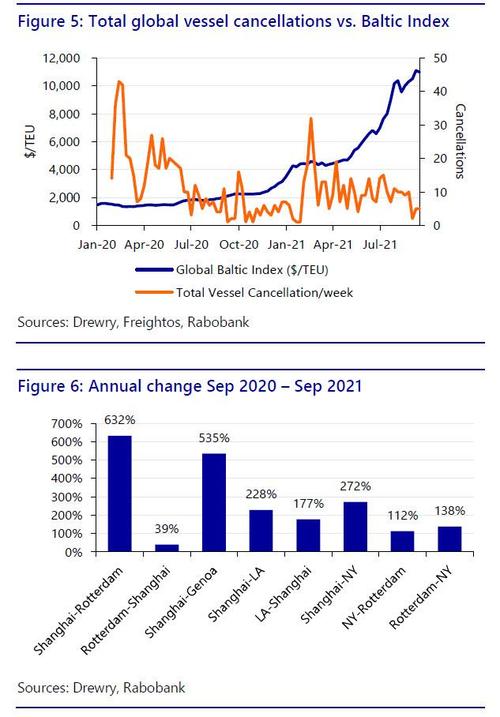

In such a context, it was only normal to expect a rise in container rates. Over January-December 2020 the Global Baltic index (the world reference for box prices) increased by 115% from $1,460 to $3,140/TEU.

However, as figure 2 shows, things then changed dramatically in 2021 for a variety of reasons.

As can be seen (figure 5), cancellations alone cannot explain the price surge seen in the Baltic Dry Index -- the leading international Freight Rate Index, providing market rates for 12 global trade lines-- and on key global shipping routes (figure 6).

So what did?

We have instead identified five key themes that have pushed up shipping costs, which we will explore in turn:

· Suez – and what happened there;

· Sickness – or Covid-19 (again);

· Structure – of the shipping market;

· Stimulus – most so in the US; and

· “Stuck” – as in logistical congestion.

Suez

On March 23rd 2021, a 20,000TEU giant vessel, the Ever Given, owned by the Taiwanese carrier Evergreen, was forced by strong winds to park sideways in the Suez Canal, ultimately obstructing it. For the following six days, one of the fundamental arteries of trade between Europe, the Gulf, East Africa, the Indian Ocean, and South East Asia was closed for business.

While the world realized how fragile globalized supply chains are, carriers and shippers were counting the costs.

370 ships could not pass the Canal, with cargoes worth around $9.5bn. Every conceivable good was on those ships. The result was more unforeseen delays, more congestions and, of course, more upward pressure on container rates.

Sickness

New COVID-19 Delta variant outbreaks in 20201 forced the closure of major Chinese ports such as Ningbo and Yantian causing delays and congestion that reverberated both in the region and globally. Vietnamese ports also suffered similar incidents.

These closures, while not decisive blows, contributed to taking shipping capacity off the global grid, hindering the recovery trend. They were also signals of how thin the ice is that global supply chain are walking on. Indeed, Chinese and South-east Asian ports are still suffering the consequences of those earlier closures, with record queues of ships waiting to unload.

Structure

When external shocks cause price spikes it is always wise to look at structure of the sector in which disruption caused the price spike. This exercise provides precious hints on what the “descent” from the spike might look like.

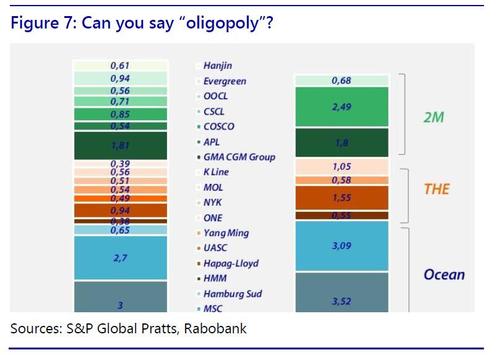

Crucially, in the shipping sector, consolidation and concentration has achieved levels that few other sectors of the economy reach.

In the last five years, carriers controlling 80% of global capacity became more concentrated, with fewer operators of even larger size (figure 7). However, this is just the most obvious piece of the puzzle.

Carriers did not decide on the lockdowns or port closures; but they exploited their position in the global market when the pandemic erupted. In a recent report, Peter Sands from BIMCO (the Baltic and International Maritime Council) put it as follows: “Years of low freight rates resulting in rigorous cost-cutting by carriers have left them in a great position to maximise profits now that the market has turned.”

In our opinion, the real change started in 2017, when the three main container alliances (2M, THE, and Ocean) were born. This changed horizontal cooperation between market leaders in shipping. The three do not fix prices, but via their networks capacity is shared and planned jointly, fully exploiting economies of scale that are decisive to making a capital-intensive business profitable and efficient. Unit margins can stay low as long as you move huge volume with high precision, and at the lowest cost possible.

To be able to move the huge volumes required by a globalized and increasingly e-commerce economy at the levels of efficiency and speed demanded by operators up and down supply chains, there was little [were few] other options than to cooperate and keep goods flowing for the lowest cost possible at the highest speed possible. A tight discipline of cost was imposed on carriers, who also had to get bigger.

This strategy more than paid off in the Covid crisis, when shippers demonstrated clear minds, efficiency in implementing capacity control, and a key understanding of the elements they could use to their advantage: in other words – how capitalism actually works[can work].

Carriers did not decide on the lockdowns or port closures; but they exploited their position in the global market when the pandemic erupted. In a recent report, Peter Sands from BIMCO (the Baltic and International Maritime Council) put it as follows: “Years of low freight rates resulting in rigorous cost-cutting by carriers have left them in a great position to maximise profits now that the market has turned.”

Crucially, this market structure is here to stay - for now. It is a component of the global system. Carriers will continue to exert pressure and find ways to make profit but, most importantly, they will make more than sure that, this time, it is not only them that end up paying the costs of rebalancing within the global system.

In short, the current market allows carriers to make historic levels of profits. However, in our view this is not the end of the story – as shall be shown later.

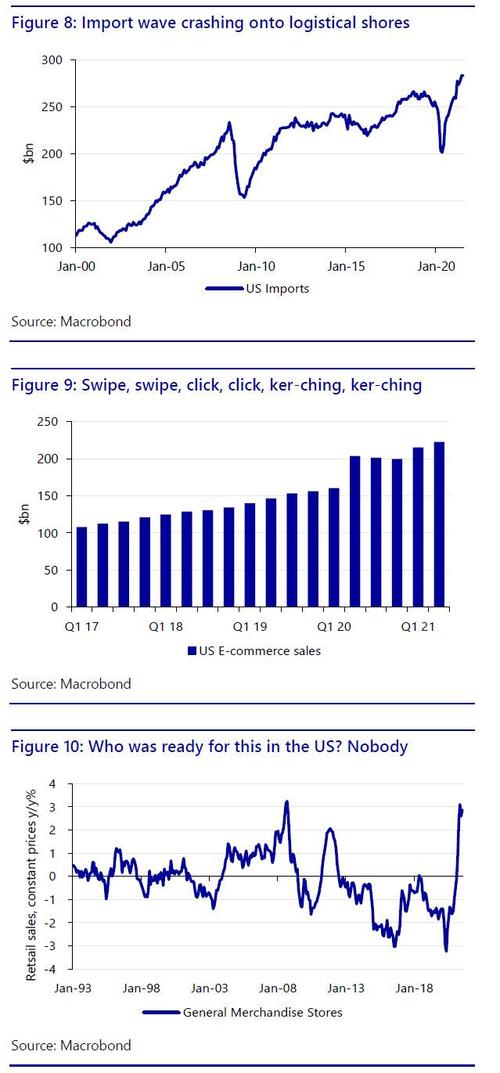

Stimulus

2020 and 2021 saw unprecedented economic

shocks from Covid-19, as well as unprecedented economic stimulus from some

governments. In particular, the US government sent out direct stimulus cheques

to taxpayers. With few services to spend the money on, it was instead centred

on goods.

Hence, consumer demand for some items is

red-hot (figures 8-10).

The consequences of this surge in buying on top of a workforce still partly in rolling lockdowns, and against a backlog of infrastructure decades in the making, was obvious: logistical gridlock.

Moreover, with the US importing high volumes, and not exporting to match, and its own internal logistics log-jammed, there has been a build-up of shipping containers inside the US, and a shortage elsewhere. Shippers are, in some cases, even dropping their cargo and returning to Asia empty: the same has been reported in Australia.

Against this backdrop, the US is perhaps close to introducing further major fiscal stimulus, with little of this able to address near-term infrastructure/logistical shortfalls. Needless to say, the impact on shipping, if such stimulus is passed, could be enormous.

As such, while central banks and governments still insist that inflation is transitory, supply-chain dynamics suggest it is in fact closer to becoming systemically entrenched.

Stuck

In normal times, a surge in consumer spending would be a bonanza for everyone: raw material producers, manufacturers, carriers, shippers, and retailers alike. In Covid times, this is all a death-blow to global supply chains.

Due to misplaced global capacity,

- high export volumes cannot be moved fast enough,

- intermediate goods cannot reach processors in time, and

- everybody is fighting to get a container spot on the ships available.

Ports cannot handle the throughput given the backlog of containers that are still waiting to be shipped inland or loaded on a delayed boat.

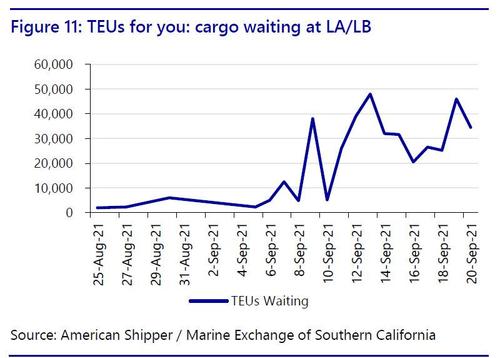

It is not by chance that congestion hit record peaks at the same time in Los Angeles – Long beach (LA - LB), and in the main ports in China, the two main poles of transpacific trade.

Clearly, LA - LB cannot handle the surge in imports, the arrival queue keeps on growing by the day (figure 11). There are now plans to shift to working 24/7. However, critics note that all this would do is to shift containers from ships to clog other already backlogged areas of the port, potentially reducing efficiency even further.

Meanwhile, in Shanghai and Ningbo there were also 154 ships waiting to unload at time of writing. The power-cuts seeing Chinese factories only operating 3-4 day weeks in many locations suggest a slow-down in the pace of goods accumulating at ports, but also imply disruption, shortages, and delays in loading, still making problems worse overall. Imagine large-scale US stimulus on top of a drop in supply!

…and unstuck?

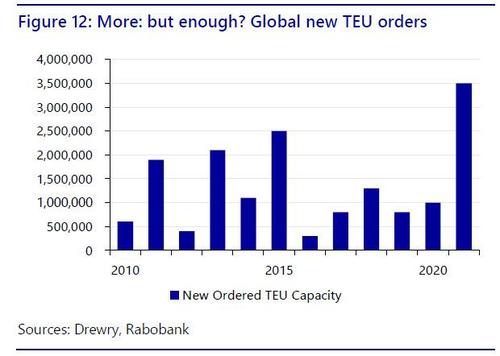

The shipping business would logically seem best-placed to get out of this situation by increasing vessel capacity. Indeed, orders of new ships spiked in 2021, and in coming years 2.5m TEUs will come on stream (figure 12). However, this will not arrive for some time, and may not sharply reduce shipping prices when it does.

Indeed, the industry --which historically

operates on thin margins, and has seen many boom and bust cycles—knows all too

well the old Greek phrase:

“98 ships, 101 cargoes, profit;

101 ships, 98 cargoes, disaster”.

They will want to preserve as much of the current profitability as possible, which a concentrated ‘Big 3’ makes easier.

Tellingly, a recent article stressed: “Ship-owners and financiers should avoid sinking money into new container vessels despite a global crunch because record orders have driven up prices, according to industry insiders.”

True, CMA CGM just froze shipping spot rates until February 2022, joining Hapag-Lloyd. Yet in both cases the new implied benchmark is of price freezes at what were once unthinkable levels – not price falls.

To conclude, shipping prices are arguably very high for structural reasons, and are likely to stay high ahead – if those structures do not change. On which, we even need to look at the structure of ships themselves.